What’s in the UK’s new financial inclusion strategy?

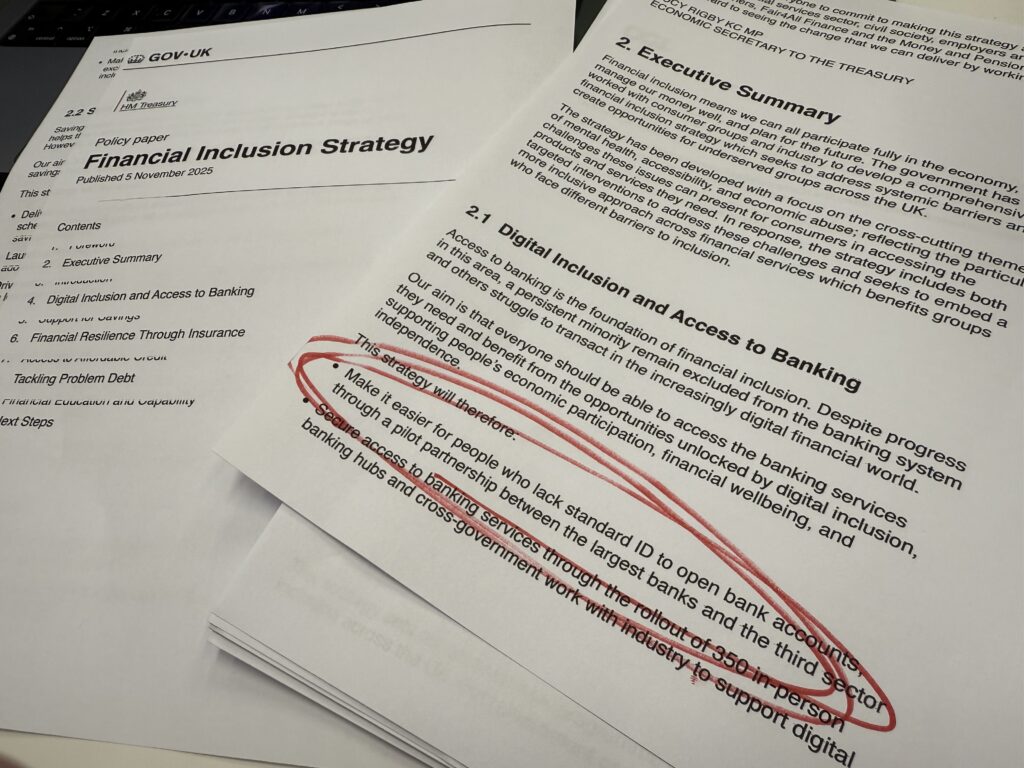

The UK government has finally published its first national Financial Inclusion Strategy, setting out how it plans to make the financial system work for everyone, not just those who already fit the mould.

It’s a serious piece of work that recognises how access to banking, savings and credit is becoming a basic part of modern life, and how many people are still left out.

The headline message is that financial inclusion is not just about money. It’s about identity, access, and design.

A joined-up plan

The strategy brings together government, regulators, banks, and charities under a shared goal: to remove the barriers that stop people from fully taking part in the financial system.

It focuses on six areas:

- Digital inclusion and access to banking

- Support for savings

- Financial resilience through insurance

- Access to affordable credit

- Tackling problem debt

- Financial education and capability

Running through all of these are three cross-cutting themes: mental health, accessibility, and economic abuse. The idea is that exclusion is more than just some people having more money than others; it’s about systems that aren’t made with everyone in mind.

Identity and Verification Working Group

For those of us working on digital ID, this is the most significant part of the document.

By the end of this year, UK Finance will convene an Identity and Verification Working Group to design a pilot that helps people open bank accounts without standard ID such as a passport or driving licence.

This is really welcome news to us and indicates that our inclusive fallbacks, like a trusted referee, are working and have the potential to go further.

The group will bring together banks, regulators and the third sector, with a remit to test new, safe ways of proving identity and address, improve consistency between banks, and report progress to HM Treasury every six months.

That might sound dry, but it’s a huge step forward.

The inability to pass a traditional “know your customer” check is one of the biggest barriers to financial inclusion. 11 million people in the UK don’t have a passport or driving licence and struggle to access vital services. It’s called ID poverty.

The strategy explicitly recognises this as a structural problem and tasks industry with solving it. It also connects to the government’s new push for digital ID, hoping that a free, privacy-preserving credential will help people can use to prove who they are online and in person. If the problem of universal enrolment can be solved, it will be transformative.

Access to banking and digital inclusion

The strategy makes clear that access to a bank account is the foundation of participation in the economy. Alongside the identity pilot, it commits to:

- The rollout of 350 new banking hubs providing in-person services through partnerships with the Post Office.

- Continued support for the Digital Inclusion Action Plan, helping people who are offline to get connected and confident using online banking.

- A new Inclusive Design Working Group, also led by UK Finance, to ensure financial products are usable by everyone, including disabled and vulnerable customers.

Together, these initiatives aim to make sure nobody is shut out just because they don’t have the right ID, device, or digital skills.

Credit, savings and financial resilience

The strategy also looks at how to help people build financial resilience. It pledges to:

- Launch a £30 million Credit Union Transformation Fund to modernise technology and help credit unions scale.

- Back a small-sum loans pilot led by Fair4All Finance, testing how mainstream banks can provide affordable credit for short-term needs.

- Reform credit-union common bond rules so they can serve a wider membership.

- Establish a National Coalition of Employers to promote payroll savings schemes, backed by an FCA statement giving employers confidence to offer them.

- Expand the Help to Save scheme so more people on Universal Credit can benefit from government-matched savings.

Why it matters

The Financial Inclusion Strategy doesn’t create new laws or obligations by itself, but it does push things forward. It shows that financial inclusion is moving from charity work to core infrastructure, something every bank, fintech and regulator is expected to take seriously.

The formation of the Identity and Verification Working Group is the clearest acknowledgment yet that “ID poverty” is serious, and that fixing it is central to improving access to banking, credit and fair financial services.

For those of us building technology in this space, it’s welcome validation, and a sign that better ways to prove who we are are finally on the government’s agenda.

You can read the full 59-page strategy here, or read our take on the tech required to make it real.