How to fix identity fraud before it happens

Last week, I had the pleasure of joining the Cifas annual Member Forum, both to show off Vouchsafe and to speak on a panel about the future of identity fraud prevention.

A huge thank you to Mark Courtney for chairing the session and inviting us to take part, and to my fellow panellists for a smart and timely conversation.

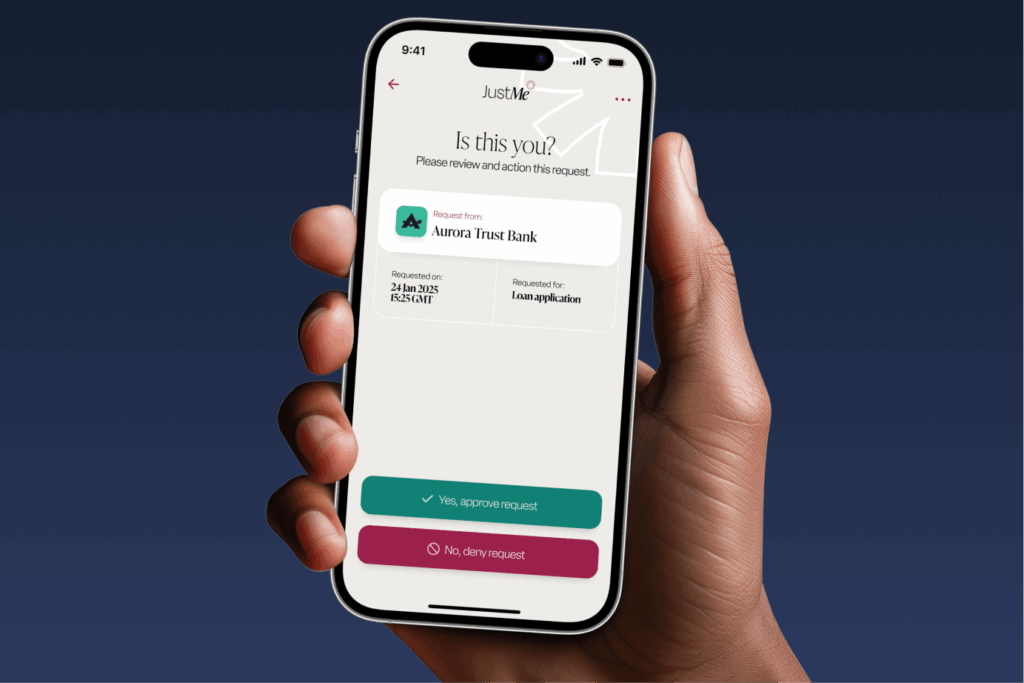

It was a big moment for Cifas too as they launched JustMe, a new app designed to stop identity theft before it leads to fraud.

JustMe works by asking the real person to confirm whether they’re applying for a loan or opening an account, using a push notification at the point of use.

It’s a really powerful idea that builds on the push notifications mobile banking apps already send, and it’s the kind of thing that needs the clout of an organisation like Cifas to work.

We’re proud to be supporting the development of JustMe, and it was an honour to be part of the conversation about how to make this all work at scale.

A few more reflections from the day:

The market is not ready for digital ID

The government has said it wants to make digital ID mandatory for right to work checks by the next election. Other countries, like the US and those in the EU, are already further ahead, and this week the UK launched its first credential in the new digital wallet: the digital Veteran Card.

On the ground, the picture is more mixed. Many attendees expressed doubts about whether the ecosystem is ready to support the shift, or if the scheme would even happen.

Vouchsafe’s point of view is that even if this particular scheme doesn’t land, the future is digital. Accepting digital evidence will soon be the norm, and we’ve published sector guidance on how to get ready.

Enrolment is the unsolved challenge

Large-scale identity systems need large-scale enrolment.

Whether we’re talking about JustMe, Universal Credit, or the government’s new mandatory digital ID scheme, the challenge is the same: how do you design an onboarding process that’s both secure and inclusive?

Too exclusive, and it risks leaving people out, as well as forcing organisations to keep running the legacy systems these programmes were meant to replace. Too insecure, and it creates a back door for stolen or synthetic identities to slip through unnoticed.

Any national or sector-wide identity programme will live or die on the strength of its enrolment. Getting this part right is fundamental. In a country like the UK, where ID poverty is so severe, it’s especially important.

Prevention is better than cure

Payments have come a long way. “Approve this payment” messages and other real-time checks help stop fraud before it happens.

But in other areas like credit applications, insurance or account openings the same level of protection doesn’t exist yet.

That’s why I think JustMe could make a real difference. It flips the model from detection to prevention, giving the real person a chance to confirm what’s happening before any damage is done.

If you’d like to talk more about what we discussed on the panel, or about the future of digital identity, I’d love to hear from you. Feel free to get in touch via LinkedIn or email chloe@vouchsafe.id.