Why digital finance still excludes adults with learning disabilities

Adults with learning disabilities often face huge barriers when it comes to managing their own money. Most digital tools aren’t built with them in mind, and the legal frameworks that shape financial access rarely reflect their needs.

Project Nemo is a campaign working to change that. Their latest report sheds light on the exclusion built into financial services today, and what it would take to design something better.

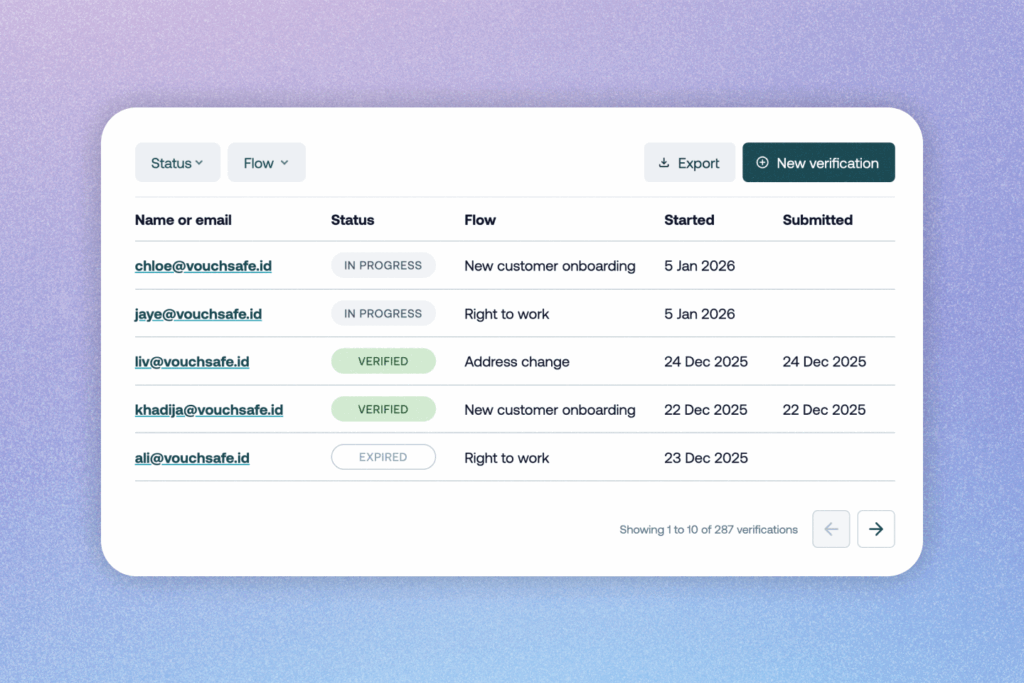

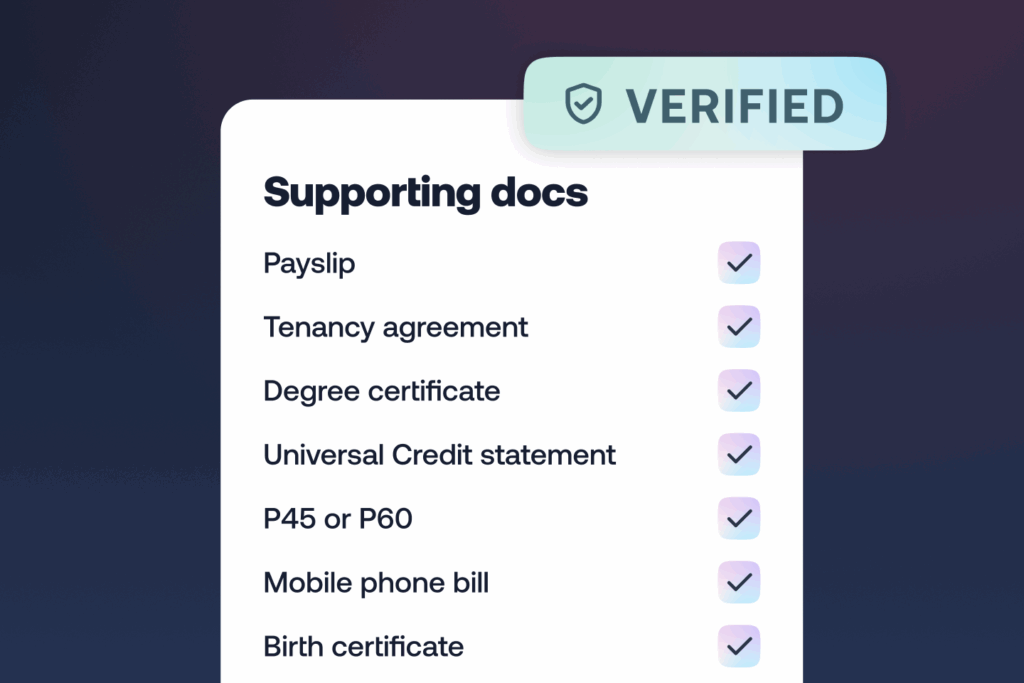

The report was launched today in London. Vouchsafe attended the event and was proud to be named one of the winners of Project Nemo’s innovation challenge back in March. Our inclusive KYC tools were picked for their ability to help more people with disabilities open bank accounts and access finance.

What the report found

- 91% of people with a learning disability require someone to help them make decisions to safely navigate everyday life

- 32% do not have a bank account in their own name

- 87% have informal and often unsafe workarounds, including pretending to be the account holder when contacting the bank and sharing passwords

Project Nemo’s research found that people are often forced to choose between two extremes: full control with no safeguards, or a loss of autonomy through power of attorney or appointeeship. There is not much infrastructure for anything in between.

A legal grey area

Current legal systems tend to see capacity as all-or-nothing. But many people sit in a middle ground: able to manage money with the right digital or social support. The report argues for more flexible safeguards, which offer support without taking over.

The idea of “trusted supporters” runs through the report. These are people who can assist without removing the individual’s agency, usually a relative or partner.

Current landscape and lived experience

Many people with learning disabilities manage money informally, with help from family or carers. Over 70% still rely heavily on cash, driven by inaccessible interfaces and anxiety around digital payments.

These arrangements are common, but they can leave people vulnerable to abuse or overly reliant on others.

Participants in Project Nemo’s workshops said they want tools that help them stay in control, but with built-in options for support. Spending limits, alerts, and the ability to loop in a trusted contact were among the most valued features.

Prototypes with potential

The team tested new tools as part of the project, including a money management app designed with accessibility in mind.

Of particular note was a joint onboarding flow, where a user and their trusted supporter set up the account together and agree on permissions from the start.

Other features included real-time spend tracking and tailored controls. The goal being to reduce reliance on informal support and give people more confidence in managing their finances.

You can read the full report on Project Nemo’s website. If you are interested in making your KYC or onboarding process more inclusive of those with disabilities, contact chloe@vouchsafe.id.