Break free from pay-per-check KYC with Flex

The way businesses pay for KYC is broken.

Right now the pay‑per‑check model is rampant. Actual prices range from pennies to tens of pounds per verification, depending on what is included.

There’s two big problems with this. First, businesses are disincentivised from expanding compliance as they grow. It has caught out big names like Monzo in recent months.

Second and most important, fraudsters don’t think in single checks. One step at onboarding is no longer enough; lasting protection is required.

Getting away from one‑off checks

A strong, integrated anti-fraud model tops up trust over time:

- Lightweight background checks at sign‑up

- Enhanced due diligence with extra evidence collected for contra‑indicated users, flexible enough to avoid penalising people in ID poverty

- Real-time alerts when a verified user appears on a high‑risk list or receives a Cifas flag

- Light re‑verification before a risky action, confirming the user is still the same person as verified

The FCA and other regulators now expect firms to maintain this kind of continuous due diligence.

Trying to stitch it together under pay‑per‑check pricing would be a logistical nightmare, unattainable except to the largest enterprises with multi-million pound budgets.

The monthly bill would probably be a mystery to the customer, and possibly to the vendor as well. Traffic spikes only add more uncertainty.

Our solution

We want to provide an all‑in compliance platform that improves and gives you more over time, not less. Vouchsafe’s hallmark is flexibility: mix‑and‑match verification routes and on‑demand human support, so your compliance adapts as fast as your product. Getting the pricing model right is crucial.

We are launching Flex, a single monthly subscription that delivers unlimited verification flows and checks, proactive compliance tools such as Alerts and Smart look‑ups, and real‑time user support. Flex replaces unpredictable usage-based invoices with one flat fee.

And through Vouchsafe for Good, the same enterprise-grade protection is in reach for every organisation that shares our financial inclusion mission.

What to expect next

Our capabilities will keep growing:

- Checks against credit‑bureau data

- Automatic recognition of rare or unusual identity documents

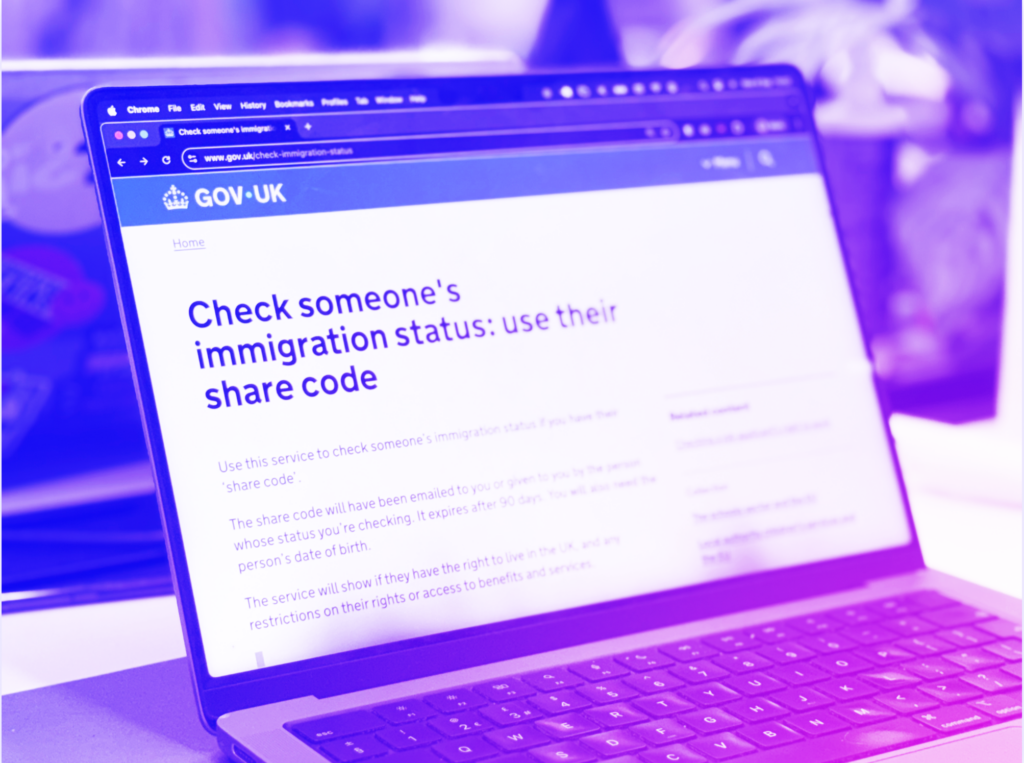

- Automatic support for eVisas and other kinds of digital ID

- Vouchsafe Radar: predictive fraud insights powered by the Vouchsafe network

If you are on Flex, you will receive all of this at no extra cost.

To discuss Flex or learn what is coming, email chloe@vouchsafe.id, or try it out now.