What digital ID really means for banks, lenders and fintechs

The short version: start thinking now about how digital ID affects your onboarding and KYC flows.

The Vouchsafe mission, team and founders

Learn how to use Vouchsafe and integrate it into your systems

Endpoints, code samples and tutorials

Historic and current incidents

Discover how Vouchsafe is reducing fraud, strengthening compliance, and widening access to fair credit.

The short version: start thinking now about how digital ID affects your onboarding and KYC flows.

Is your infrastructure designed for growth, or just gatekeeping? Across the UK, millions remain unbanked or underbanked because the infrastructure behind identity, payments…

The full transcript of Chloe’s keynote at Digital ID and Payments: The Moment of Truth, our industry panel on 5 Feb in London.

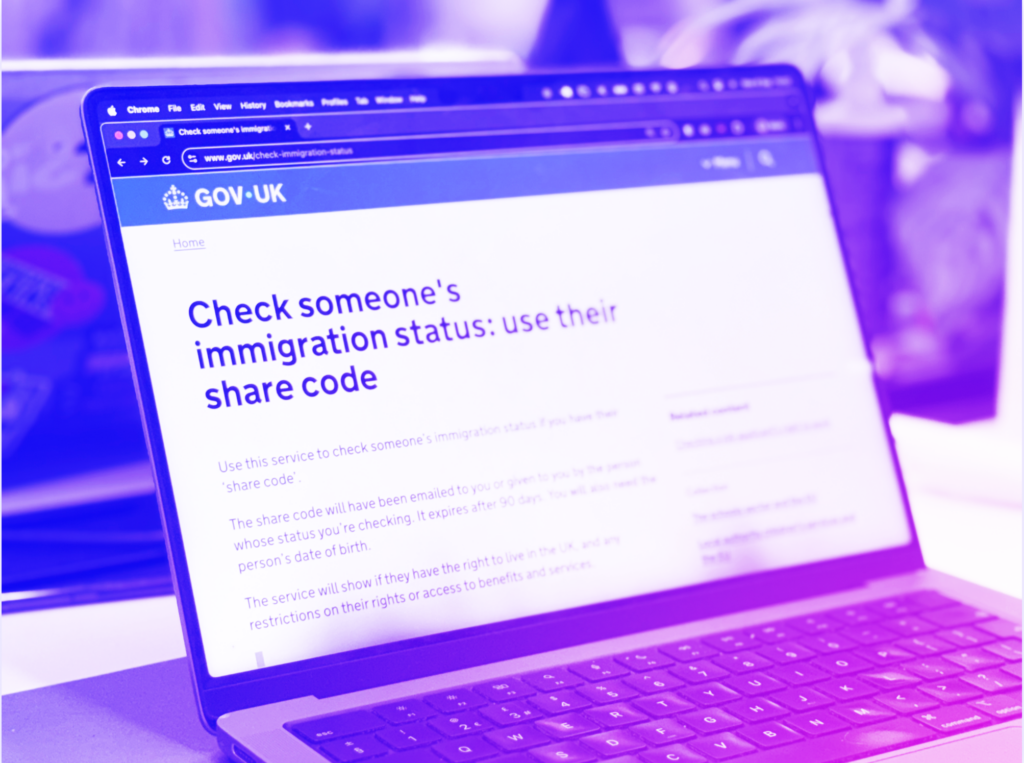

TL;DR: You can now verify a customer’s UK immigration status, right to work, and right to rent using our new eVisa APIs. We’ve…

A compliance and adoption guide for businesses as the UK rolls out mobile driving licences in 2026

mDLs are coming this year. Here’s what’s changing and what it means for you.

When the Online Safety Act went live in 2025, the web was filled with teens boasting that they’d managed to defeat the checks…

We’ve added a new API endpoint to return the artefacts collected during a verification.

2026 is the year it all changes Across the world, pilots are becoming infrastructure. Every EU country must launch a national digital ID…

Our take: this is the best possible news for digital ID in the UK; a return to a much saner, more promising plan that’s already in progress.

Try all our features with our 14-day free trial. No credit card required.