Vouchsafe vs Yoti in-depth tool comparison

Vouchsafe and Yoti are both powerful identity verification platforms, trusted by risk and compliance teams to onboard customers and prevent fraud. But they are designed for different jobs, and those differences matter in regulated financial services.

How is Vouchsafe different?

1. Works out of the box for UK financial services

Vouchsafe is built specifically for KYC/AML in financial services, including account opening and applications for credit. It covers the full scope from identity and address verification through to ongoing monitoring.

We provide compliant, battle-tested templates aligned to FCA and JMLSG guidance, so you can get set up quickly without having to design and configure a completely custom flow.

2. We prioritise digital ID acceptance

Many customers already have recognised digital IDs they understand and trust, including eVisas, mobile driving licences and EU digital wallets.

Vouchsafe asks for these first, which speeds up onboarding and cuts your exposure to forged or manipulated documents.

3. We can verify more customers

1 in 5 UK adults struggle to prove their identity through traditional routes. They may have recently moved, have limited credit history, or not hold a passport or driving licence.

Vouchsafe brings support for Vouching. Users can get verified by providing a trusted referee, which works like a guarantor.

It’s a compliant, secure approach that allows you to onboard a customer who would normally be shut out.

This makes us a particularly good fit for ethical lenders; credit unions, building societies and CDFIs.

4. Simple pricing, with a free trial

You can sign up to Vouchsafe and get a free 14 day trial of all functionality with no usage limits.

After that, the platform is simply £399/month, with all features included. There are no add-ons, integration or setup fees and there is no need to talk to sales.

Comparing Vouchsafe and Yoti

Identity verification

Vouchsafe’s global identity verification starts by asking the customer to share a digital ID from a provider you accept. We use location to show the most relevant options.

For example, a customer in the UK may be asked to share an eVisa or mobile driving licence, while a customer in Finland may be prompted to use Finnish BankID.

If a digital ID is not available, the customer can scan a recognised photo ID and complete a biometric selfie check. If neither route is possible, a trusted referee can complete the process on their behalf.

Yoti also supports a wide range of international identity documents and biometric checks. However, it does not accept third-party digital IDs beyond the Yoti app itself, and does not offer a vouching-based fallback.

Address verification

Vouchsafe provides compliant address verification as part of the core platform.

Where available, a verified address is taken directly from a digital ID. If not, Vouchsafe checks credit bureau data to identify the most recent address associated with the customer.

Customers without a strong data trail can provide one or more supporting documents from a wide range of options. Vouchsafe will automatically check the document has not been tampered with, is addressed to the right person and is recent enough for you to accept.

Yoti has very limited address verification capabilities through scanning one of four documents:

- Council Tax bill

- Bank statement

- Phone bill

- Utility bill

eKYC and background checks

Vouchsafe allows you to run background checks using Smart lookup, without first asking the customer to upload documents.

By checking identity details against AML lists, credit reference data and other signals, you can decide immediately whether a customer can proceed or what additional evidence is required.

Yoti does not offer an equivalent pre-check capability and generally requires the user to submit identity evidence before checks can be performed.

Ongoing monitoring, AML and fraud screening

Vouchsafe combines ongoing AML screening with Radar, a network-based fraud detection layer.

Verified customers are re-checked daily against global sanctions, PEP and watchlists, with alerts delivered by email and webhook.

Radar goes further by identifying suspicious patterns across the wider Vouchsafe network, not just within a single customer journey. This helps surface fake, stolen and high-risk identities that may not yet appear on any list.

Signals are anonymised and shared across the network, preventing known fraud patterns from being reused elsewhere. This intelligence is built in by default.

Yoti does flag fraud spotted on their network but does not appear to include this capability in their ongoing monitoring.

Integration

Vouchsafe offers no-code integrations with over 8,000 tools via Zapier, as well as APIs and SDKs for common languages including Node.js and PHP.

All integrations are included as standard, and the platform can also be used stand-alone when getting set up.

Yoti provides a smaller integration gallery, and must be used as an integrated component, rather than a standalone system.

Support

Both Vouchsafe and Yoti provide extensive integration, onboarding and ongoing support to businesses.

However, only Vouchsafe provides support directly to end users via live chat and email, and in particularly tricky cases, over the phone.

We help your users get verified, so it doesn’t end up causing extra manual work for your own team.

Security and compliance

As financial institutions are regulated by the FCA, Vouchsafe and Yoti are both regulated by the Office for Digital Identities and Attributes (OfDIA), via their membership of the UK digital identity and attributes trust framework.

This means both companies can be used for right-to-work, right-to-rent and DBS checks. Vouchsafe alone also uses this membership to verify credentials from the GOV.UK wallet app.

Vouchsafe’s compliant templates and onboarding support mean that usage is guaranteed to meet regulatory and security requirements.

Frequently asked questions

How much does Vouchsafe cost?

Vouchsafe costs £399/month for all features. There are no setup or integration fees.

For occasional simple checks, you can use the pay as you go plan, paying just 99p per piece of evidence verified.

How much does Yoti cost?

Yoti’s pricing is custom, and is based on industry, use case and volume.

Notably, retries and failed verifications are still charged, so the overall cost can be much more than projected if customers need several attempts at scanning a document or their face.

Does Vouchsafe or Yoti offer a free trial?

Vouchsafe offers a 14 day free trial of all functionality.

Yoti offers demos and sandbox access to evaluate the platform.

How long does it take to implement Vouchsafe?

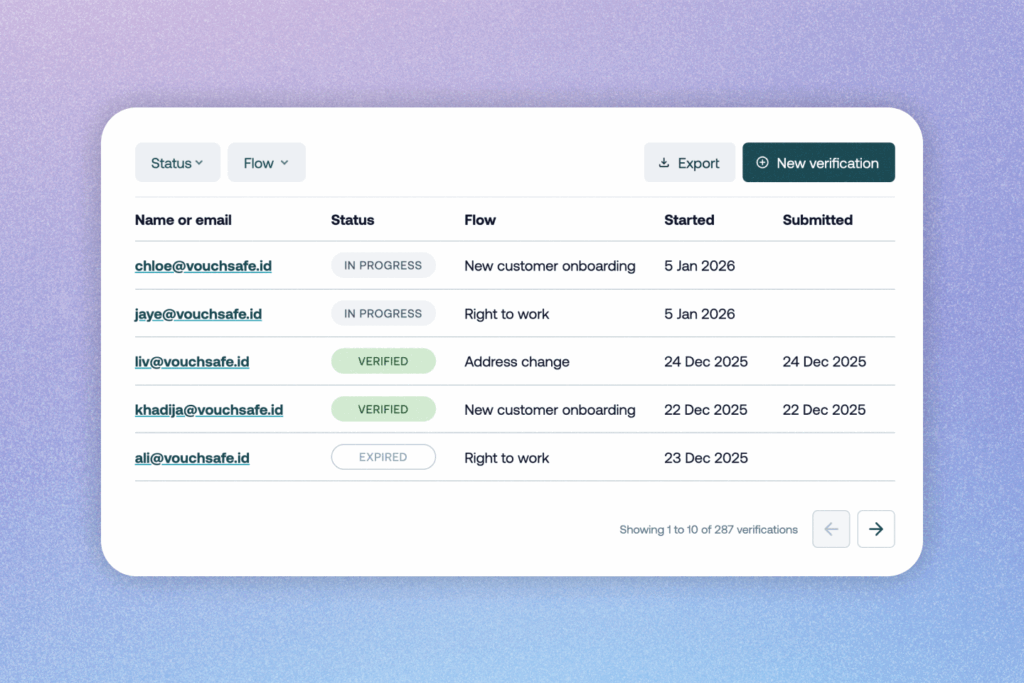

Because we offer a stand-alone dashboard and compliant templates, Vouchsafe can be used for basic checks within minutes.

For more complex use cases, we offer free onboarding support to design your verification flows and connect to your other tools, which we find can normally be completed in a week or two.

What are some other alternatives for KYC/AML?

Other KYC and identity verification providers include GBG, Persona, Entrust and Stripe.

We recommend choosing a platform with strong regulatory alignment in your target markets, transparent pricing and a clear roadmap for digital ID adoption.

Vouchsafe is the KYC/AML platform that lets you accept the digital IDs customers already have. We help you onboard more people, faster, with less manual effort. Book a chat and quit scanning documents today.