Incuto partners with Vouchsafe to double credit union membership with better onboarding

UK credit unions have committed to doubling their membership by 2035, aiming to welcome two million new members. The target supports the UK government’s ambition to double the size of the mutual and cooperative sector.

Meeting this goal will take more than ambition. It requires faster, more inclusive onboarding that works for everyone.

Through a new partnership with Incuto, credit unions will be able to activate Vouchsafe with a single click and start automatically onboarding more members.

Credit unions currently have to turn down 20-60% of applicants for having insufficient or incorrect documentation. One credit union told us that this means they’ve had to turn down £2.8m in lending since the start of this year alone.

Vouchsafe’s flexible, automated identity verification and KYC technology is entirely automatic and gives an instant result.

Why this matters for credit unions

- Verify tricky documents automatically: Vouchsafe handles the kinds of ID that usually need a person to look at them, including bank statements, utility bills, benefit letters and other niche documents.

- Support that shares the load: We don’t just offer a tool; we provide wrap-around support for members who get stuck. That means fewer calls and less admin for your team.

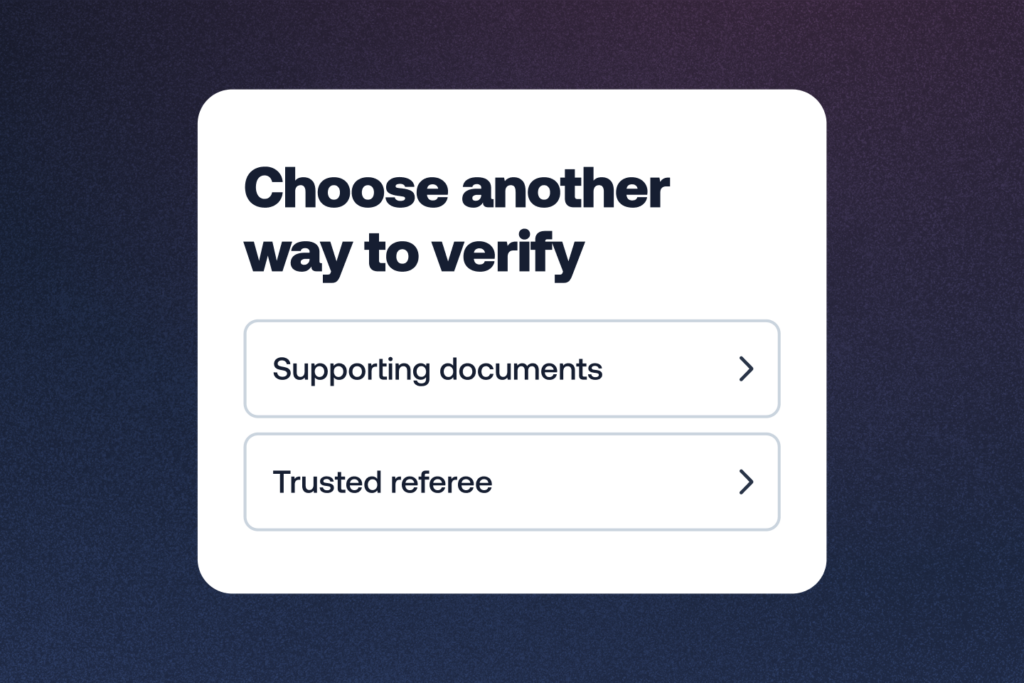

- Built-in options for people without standard ID: Our trusted referee route is an industry first, helping you verify long-standing members and new applicants who may not have a passport or driving licence.

- No integration work needed: Vouchsafe can be switched on from within Incuto with a single click. No tech team required, no systems to coordinate.

What Incuto brings to the table

Incuto helps ethical lenders grow and modernise, offering a cloud‑based platform with pay‑per‑transaction pricing; no licence fees, no lock‑ins. Their toolkit includes credit checks, accounts and payment rails via partners like Experian, TransUnion and ClearBank.

Andrew Rabbitt, CEO of Incuto said:

“We believe everyone should have access to low‑cost, high‑quality financial services. By integrating Vouchsafe directly into our platform, we make it even easier for credit unions to grow without complexity or cost”

Chloe Coleman, CEO of Vouchsafe, said:

“This partnership is a game changer for community finance. Credit unions deserve tech that works for them rather than tech that excludes people they’ve known for years.. With Incuto, turning on Vouchsafe is friction‑free, helping them welcome new members quickly, simply and inclusively.”

Ready to onboard more members?

As the sector rallies to double its membership by 2035, the Incuto/Vouchsafe partnership offers credit unions the tools to grow faster and serve members better. Together, we’re making inclusive finance a reality.

If you’re a credit union using Incuto, or exploring a modern onboarding solution, this is your moment.

Get in touch with Chloe at chloe@vouchsafe.id or reach out via the Incuto Customer team to start benefiting today.