Introducing bank account verification

A big part of our mission is to make basic financial services much more inclusive. A new feature we’re announcing today puts us further ahead of the curve.

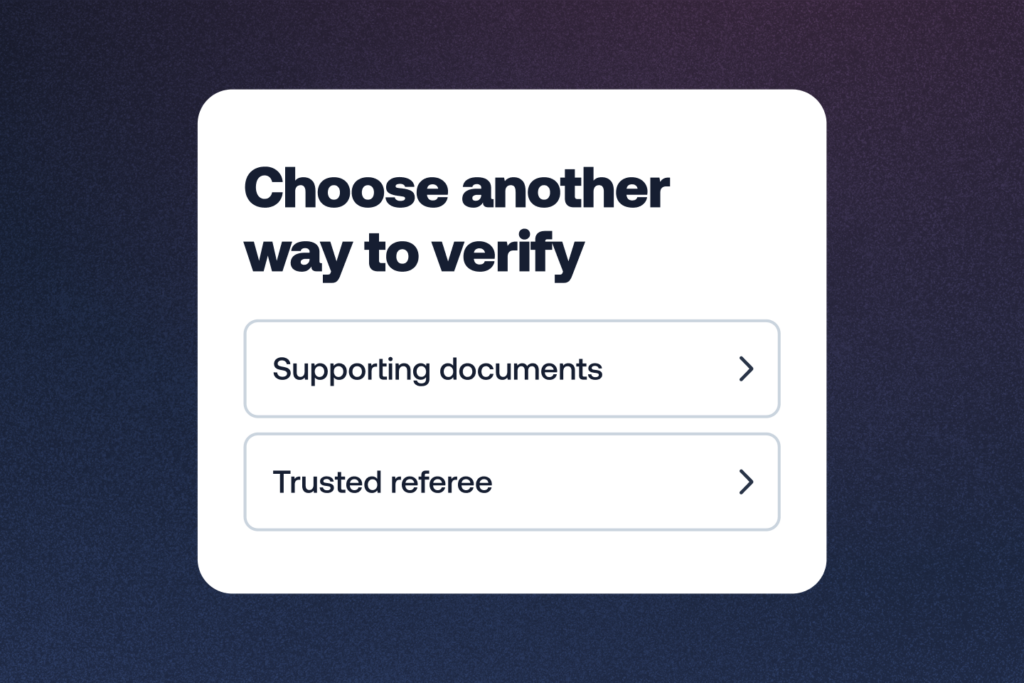

We’re already the first Know Your Customer (KYC) platform to support trusted verification through a referee — friend, family member, or anyone the user knows — filling the gaps where photo ID or reliable data may not be available.

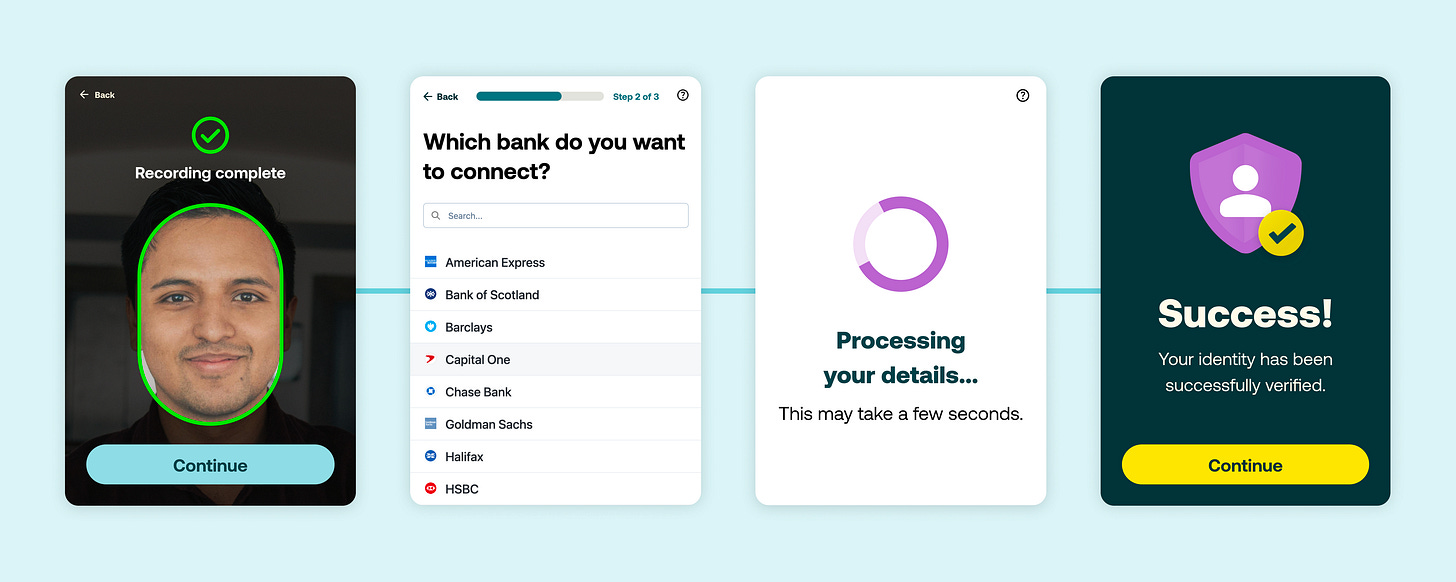

Today, we’re doubling down by introducing document-free identity verification through a connected bank account.

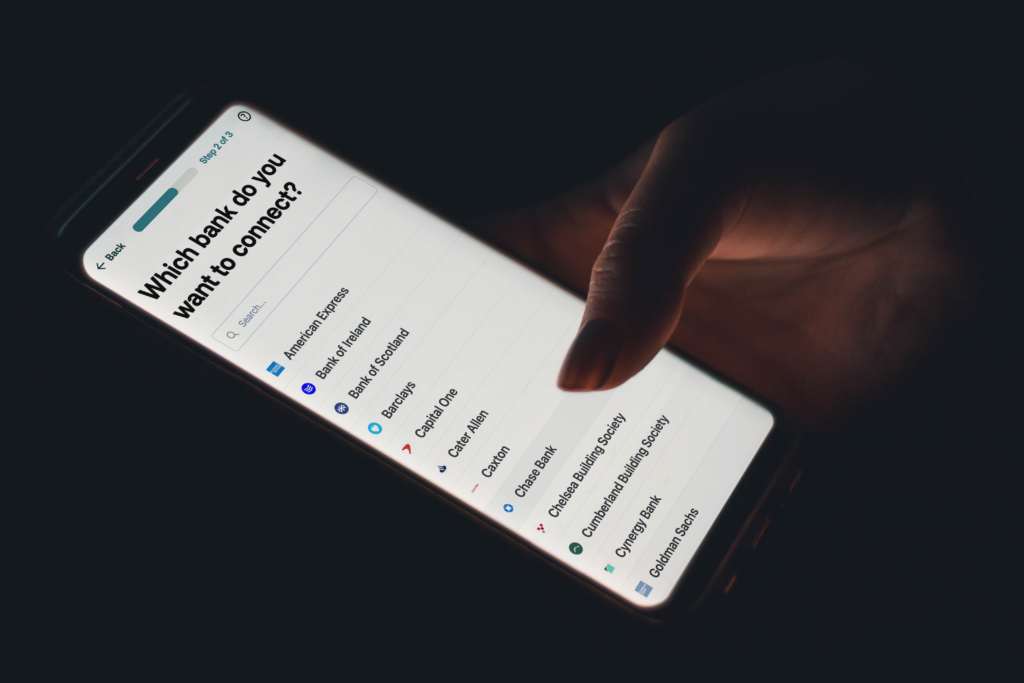

Banks are held to strict anti-money laundering standards, but provide APIs so that the data they hold can be shared with the account holder’s permission.

Most UK and EU banks are supported, and any current or savings account held by a single named individual can be accepted. So no joint or business accounts.

Vouchsafe takes the information we gain from the bank and combines it with a video selfie, so you can still be sure you’re dealing with a real person.

We then run our anti-fraud checks, so that you can get a complete picture of the user’s digital footprint.

It’s an excellent way to speed up verification, and avoid awkward document scans. It’s compliant in the UK.

This is a vital step to help people without basic forms of ID. But it’s also perfect for people who can’t remember whether their passport is buried in a drawer with allen keys or stuffed down the back of the wardrobe.

Speak to us if you’re interested in bolstering your KYC with bank account verification: hello@vouchsafe.id